Publication Categories

Media Room

Using Personas to Design Solutions for Financially Excluded Women

March 8, 2021

As any tall person who has flown in Economy class will tell you, solutions that are created for an average customer do not work well for everyone. When we do not design financial solutions specifically for women, we can unintentionally exclude them, particularly since more men than women currently use banks and therefore the “average” customer in banks’ imaginations and databases is likely to be male. Global experience has shown that, when financial products are designed without taking gender into consideration (“gender blind”), more men use them. When products are designed for women, women use them – and men often use them as well, helping the provider reach to a wider customer base.

When EFInA provided a grant to Diamond Bank 10 years ago to pilot and deploy the BETA Savings Account for women, it was one of the first products being deployed by a Nigerian commercial bank with a specific focus on lower-income women. In recent years, we have seen increasing numbers of banks and other financial service providers launch initiatives designed to reach women specifically. We at EFInA are excited by this momentum and eager to support the industry in deploying women-focused solutions, including by providing relevant research to support this process.

Financial service providers can use sex-disaggregated to identify the women’s market and track how effectively they are reaching women. In addition to using disaggregated quantitative data, effective design teams often use personas, which are built based on the habits and goals of real people. Personas that are built with an understanding of gendered social norms can help design teams develop products that are effective in reaching women, as described in this blog post from CGAP.

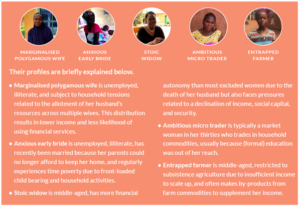

In 2019, EFInA partnered with the Central Bank of Nigeria’s Financial Inclusion Secretariat to conduct an in-depth Assessment of Women’s Financial Inclusion in Nigeria. This research generated five personas of financially excluded Nigerian women, which can be used in conjunction with other resources, such as EFInA’s Access to Financial Services in Nigeria Survey data, to design products to reach excluded women.

Personas of Financially Excluded Women

More detail about these personas, and opportunities for reaching them with financial services, is available in the full Assessment of Women’s Financial Inclusion in Nigeria report.

Our research found that financially excluded women can face unique challenges, such as being time-poor (given the need to balance multiple household and caregiving responsibilities), having a restricted range of movement (staying mostly within their homes and communities), and facing restrictions related to financial decision-making. Women want financial solutions that offer value propositions that fit the existing context of their lives. They make multiple decisions daily to manage limited income and meet their needs. Mostly, they seek solutions that provide them with greater control over their money and allow them to balance their cash flow.

Note that these personas were developed based on financially excluded women – the women who do not use any formal (regulated) or informal financial services. Different personas can be used to design products for other groups of women, such as women who are using informal financial services (savings collectors, cooperatives, etc) but are not banked, or women who are using some formal financial services such as bank accounts but do not have insurance or pensions. Some resources to help explore personas of these other groups of women include The Human Account personas of Nigerian adults (which apply to both men and women), and this design template from CGAP that helps financial service providers to develop their own personas, taking into account gender norms.

The personas and recommendations in the Assessment of Women’s Financial Inclusion in Nigeria report are a useful resource for designing solutions to reach excluded women. EFInA is also here to help – please contact us at info@efina.org.ng for support, or to share stories of how you have